The Cost of Parts Supply Fragmentation on the UK's Classic Car Parts Market

Share

Vroom Classics is built on - and powered by - the premise that the classic car market suffers avoidably from worsening fragmentation of supply, be it in car parts and accessories or even the more fun side of the hobby - scale models, memorabilia and the like. Specialist car clubs used to be an owners' saviour, but their relevance and utility are fast declining as most of them remain stuck in a world that doesn't exist anymore and are resistant - even hostile - to change.

"Car clubs used to be vital to helping owners keep their cars running, but their relevance and utility are declining fast because many refuse to adapt to a different world."

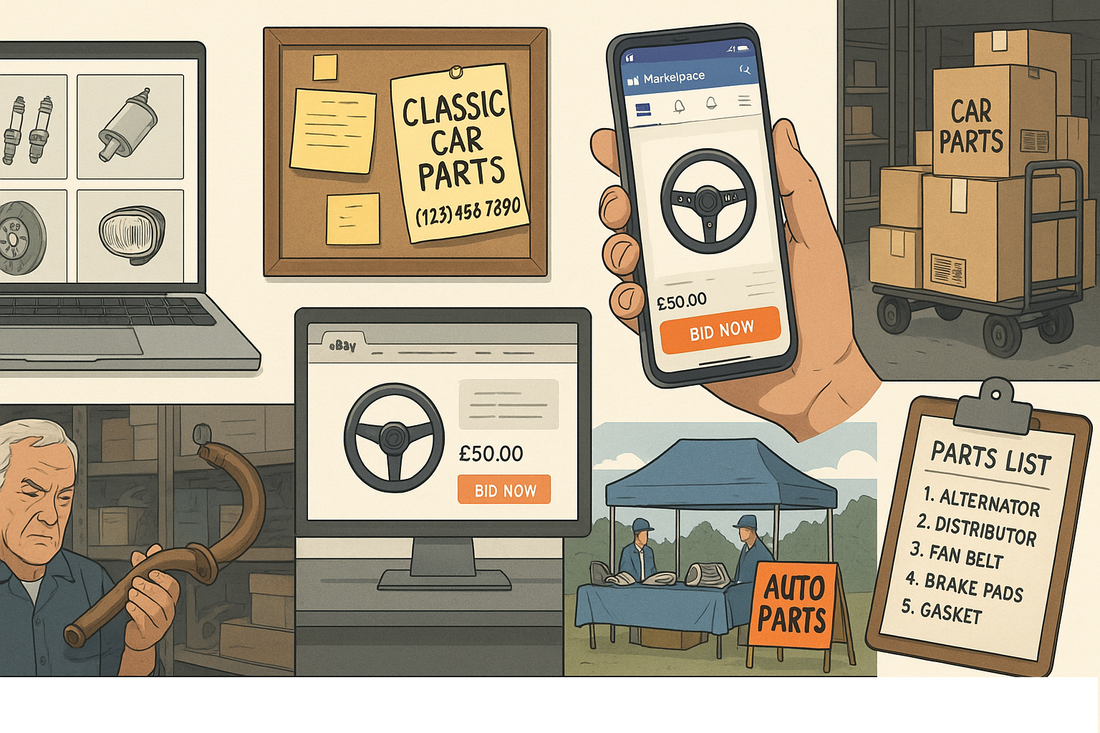

If you're restoring a Rover P6, repairing a broken down VW Beetle or tinkering with a Triumph TR6, you’ve probably felt the pain of hunting down parts. The UK’s B2C classic car parts market is highly fragmented, scattered across dozens of niche suppliers, standalone eBay listings, enthusiast clubs, and buried in specialist forums. Equally, tribal knowledge is buried deep in online forums, accessible only to the most hardcore and persistent internet jockey. And while the passion in the classic car market is impressive, the lack of a one-stop marketplace creates real headaches.

Supply is fragmented in multiple dimensions, with geographic (where the supply is physically located) and sales channel (where the supply is made available for sale) are the two most powerful dimensions - and the most easily improved, ironically, by the advent of ecommerce. And it is these two dimensions where Vroom Classics is trying to improve.

What Drives the Fragmentation?

Time, really. Where once supply was abundant, geographic and sales channel fragmentation hardly existed because both were saturated with supply. But as total supply diminished, both geographic and sales channel saturation declined, opening bigger and bigger gaps over time. Before the boom of ecommerce, sales channels were also almost entirely geographically constrained, save for those merchants using mail order sales channels e.g. Argos.

To compound the effect of geographic fragmentation, much of the supply of classic car parts still cannot benefit from the geography-busting power of ecommerce. This is because the products were mostly made before the internet existed and a many of them don't even exist online - so one of the modern world's biggest sales channels is completely unserved.

Here is a non-exhaustive list of what we think are key drivers of fragmentation and what Vroom Classics is trying to do about them.

-

Part Compatibility Data is Poor - and even big online players won't fix it

Data that describes part-to-car compatibility for classic car parts is extremely poor: incomplete, incorrect, fragmented (in thousands of sources of varying quality), and tribal knowledge (via car clubs and latterly online forums) have been the most reliable source for owners. It's such a hard problem to solve at scale that none of the big players are even trying to solve it - prioritising the lower-hanging fruit (i.e. money) available in the modern car aftermarket supply. At Vroom Classics, we are tackling this problem head on and deploying multiple parallel methods of attack: first, we're trying to recruit the custodians of the tribal knowledge and bring them all together for our customers' benefit. Second, we're partnering with the many other companies that are trying to tackle this problem (they do exist! Lots of them!) in their own, unique ways, and we're trying to pull the diverse threads together into a cohesive whole. And third, we're working to deploy the power of AI to make sense of the near-infinite knowledge - most wrong, some correct - that exists online and provide the answers that our customers need. -

Sales Channel Diversity, Crowded Internet

All suppliers, big and small, sell through some sales channel; many use both online and offline/brick-and-mortar sales channels of varying kinds. The problem is the sheer number and diversity of both online and offline channels that are available and used. The majority of supply is actually controlled by smaller suppliers, who are unfortunately also the least equipped to operate an online sales channel. Ecommerce is really hard work, and getting harder, just to get traffic to your products in the crowded internet. Combine this reality with the fact that so much inventory isn't even online yet - and it's so much work to get those products from the physical to the virtual shelf even for a small catalogue. At Vroom Classics, our mission is to bring all online sales channels together as a starting point, and not just for parts and accessories - for everything that classic car lovers want. In parallel, we're seeking partners who can help us to bring the "offline" products online in a cost-effective manner. -

Niche specialisation

A Triumph carburettor specialist, a Morris Minor trim expert—each caters to a tight segment. That’s great for depth, but not for breadth. Niche specialisation is particularly frustrated by geography, because your customers are unlikely to be around the corner and therefore are unlikely to know you exist - unless you have a gargantuan marketing budget. At Vroom Classics, a marketplace by definition breaks the niche barriers by exposing niches to a diverse clientele - and this is our mission. We hope that, in relevant cases, a niche supplier will be encouraged and able to diversify out of their niche and serve more niches. -

Low digital integration

Few suppliers maintain stock feeds or updated inventories. Most rely on manual stock control or phone-and-email enquires. Some online platforms provide good tools to help suppliers in this area, but most are actively neglecting classic cars because it's a "difficult" segment to serve "properly" - in other words, they're happy to take a commission of your sales, but won't invest in making your business more operationally effective. At Vroom Classics, we exist to fill this gap in serving the specific needs and business models of classic car market suppliers and sellers. -

Limited aggregation incentives

For small businesses, setting up on big aggregator platforms is extra work—and costly. So they stick to what they know: personal relationships and niche knowledge. At Vroom Classics, our objective is to make onboarding a zero-cost, zero-effort project (as far as feasible) for sellers already selling online, and to make it as easy as possible. You only start pay for Vroom Classics's services when you sell.

How It Affects You (and Suppliers)

-

Customers waste time and money

Repair projects stall when part A is missing or over-priced. You might overpay on delivery, or order from overseas when a UK stockist was a phone call away. Countless hours - and Great British Pounds - are spent searching endlessly across multiple websites and shops for the various bits and pieces that you need. It's a totally avoidable cost, but it requires something like Vroom Classics. -

Price & quality opacity hurts competition, hurts customers & sellers

With no clear marketplace, pricing and product quality stay wildly variable and there's little to no ultimate accountability for customers' problems: the same part might retail for £10 one day and £25 the next, just because you don’t know who else has it. Unscrupulous suppliers also routinely misrepresent their products in an effort to undercut their (better) rivals. This burns customer trust, and costs bona fide suppliers deserved sales of good quality products. Again, totally avoidable. -

Small suppliers miss out on sales

A specialist in Cambridgeshire might have hundreds of bumpers in stock—but unless a buyer finds them directly, the stock sits unused. -

Transportation inefficiencies

A Derby supplier might send you a small gasket from their store, while a nearby shop had one ready to post—and you never knew.

A Single-Marketplace Vision

Imagine a centralised UK marketplace: all suppliers upload stock, and prices update automatically. Buyers see availability and cost at a glance, and checkout with aggregated baskets in one go. Unscrupulous suppliers are systematically weeded out. The boat rises on the best quality of water, for everyone involved.

What could that save?

Even a modest 10–20% reduction in average part-price dispersion would be significant. On a £2,000 restoration project with £800 in parts:

-

Current scenario: wide price spread means one part might cost £10–£25.

-

Unified supply: pricing normalisation reduces that to £15–£18 on average.

That’s roughly £80 saved right there—and if we apply similar logic across all parts? Classic restorers could save hundreds of pounds per project. Unburdened by shipping inefficiencies, the carbon footprint also drops as parts are sourced from the closest stockist.

The Path Forward

-

Inventory standardisation: Simplify stock uploads using SKU, description, and grade data.

-

On‑boarding support: Help niche suppliers list without tech headaches.

-

Auto-fetch data: Connect via APIs or feed imports.

-

Core analytics: Show suppliers their top‑selling items and prices for data‑driven stocking.

Final Thoughts

The fragmented state of B2C classic car parts may feel like tradition, but it actually erodes value—for buyers and sellers alike. By bringing suppliers into a central marketplace:

-

Buyers get speed, clarity, and savings.

-

Suppliers tap new sales without deeper marketing investment.

-

Restorers on a budget make progress more efficiently.

For the classic car community, time is ticking—and a unified marketplace could keep the passion running smoothly. Let’s bring restoration into the digital age—without losing that analog charm.